DATAXIS regularly publishes analyses on the positioning and strategies of major global telecommunications companies.

The latest concerns STARLINK, a subsidiary of SPACE X, Elon Musk's company.

STARLINK is currently the leader in the field of LEO (Low Earth Orbit) satellites. Low orbits allow satellites to benefit from high-quality telecommunications links and also simplify launch, as launch vehicles require less energy to reach these low orbits.

In 2024, SPACE X, which owns STARLINK and covers the entire value chain (manufacturing and design of satellites and launchers, supply of user equipment, distribution logistics, and service operation), has set a target of 148 launches, 50 more than in 2023. This pace equates to one mission every two and a half days. By October 2024, SPACE X had already carried out 108 launches (with only one failure!), including 74 for STARLINK.

The increase in the number of satellites will increase available capacity and improve geographical coverage. By the end of 2024, STARLINK, which launched its first satellites in 2020, will have a fleet of more than 6,500 interconnected satellites with a total capacity of 400 Tbps. However, SPACEX plans to have 12,000 satellites, a figure that is expected to eventually rise to 42,000.

STARLINK's commercial goal is to reach 5 million customers and a presence in 100 markets by the end of 2024.

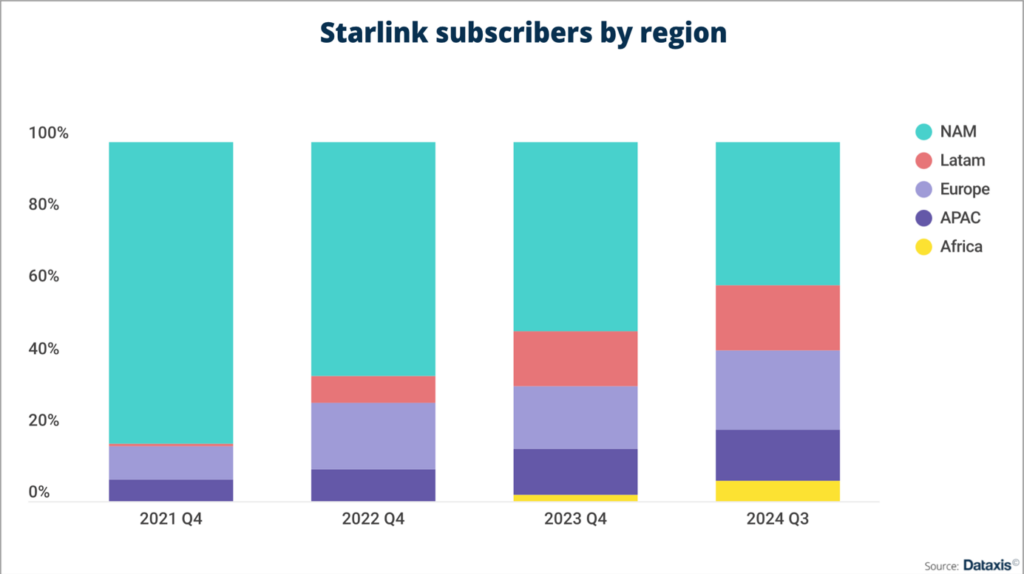

Present at the outset in North America and then Europe, subsequently launched in Oceania and South America, the company then expanded into Asia and Africa.

The main obstacle to commercial development is the high cost of the equipment needed to receive STARLINK: the price of around $450 has remained unchanged since launch. That is why the company is also testing less expensive plans and equipment to attract more customers.

At the end of 2024, the company introduced the "Mini" terminal option, given its smaller size, at half the cost of traditional equipment, and is testing a "Lite" plan in certain markets in Africa, Latin America, and Eastern Europe. For a significantly lower price, users would accept reduced service quality during peak hours. According to DATAXIS' analysis, "the 'Lite' plan and 'Mini' equipment appear to be arguments for a new phase of massive expansion."

In the coming years, STARLINK will face competition from AMAZON's KUIPER project, which is scheduled to enter the market in the first half of 2025.

KUIPER, like STARLINK, should benefit from high levels of vertical integration, making it difficult for other players to challenge their dominance.

KUIPER plans to have 3,236 satellites; a smaller fleet than its rival but with higher-capacity units. By 2027, KUIPER is expected to have the current capacity of STARLINK.

With its expanding satellite network and strategy ranging from geographic expansion to service diversification, STARLINK is strengthening its presence in the global connectivity market. At the same time, KUIPER is preparing to compete directly with STARLINK through strategic agreements that will enable it to offer competitively priced alternatives and bundled services.

Even though the war between the two global giants, AMAZON and SPACE X, will dominate newspaper headlines for many years to come, there is a third global telecommunications operator: the EUTELSAT group, formed from the merger of Eutelsat and OneWeb in 2023, which specializes in providing connectivity and video services worldwide and is a leader in GEO-LEO technology, with a fleet of 35 geostationary satellites and a low Earth orbit (LEO) constellation of more than 600 satellites.