Although the situation in France cannot really be compared to that in French-speaking Africa, the results of a recent study conducted by Kantar Worldpanel, in collaboration with Havas Media Network, shed interesting light on the importance of advertising investment and, above all, of sustained and continuous effort in this area.

This study is based on an in-depth analysis of 52 brands over an eight-year period and aims to quantify and understand the impact of declines in advertising investment on key performance KPIs.

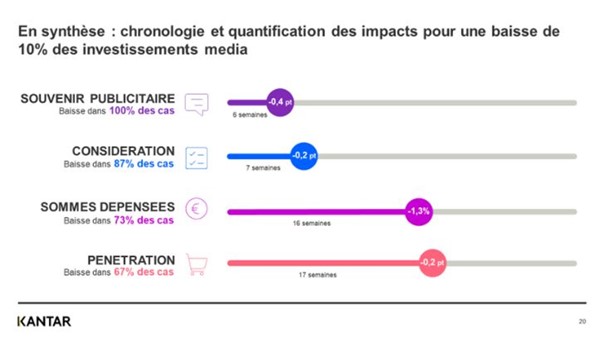

Two indicators are analyzed: the percentage of brands affected by a 10% decline in media investments and the time frame after which this impact becomes significant.

As for advertising recall, this is significantly affected for 100% of the brands studied as soon as the decline in investment slows down. In half of the cases, this impact is immediate.

In terms of consideration, 87% of brands tracked are affected when investments fall by 10%, and the impact is immediate in 45% of cases.

Revenue is also impacted, as nearly 75% of brands are affected, some of them (21%) with immediate effect . A 10% decrease in the gross media budget will reduce revenue by 1.3% on average.

Brand penetration declines in 70% of cases after 17 weeks. The most affected brands lose an average of 100,000 buyers for every 10% reduction in investment.

For large media investors (investment greater than or equal to €10 million gross), recruitment falls by less than half when they choose to divest (index 67 vs. the average), but when they are affected, the impact is significantly greater regardless of the indicator studied. The risk of being impacted is lower, but when it does occur, the consequences are more problematic.

Methodology: these data are taken from a sample of 20,000 Worldpanel panel households. They are calculated based on a universe of fast-moving consumer goods (FMCG—food, liquids, health and beauty, cleaning) and fresh self-service items.